Brilliant Strategies Of Info About How To Settle With Irs

Call the nation's most experienced tax relief pro.

How to settle with irs. Ad created by former tax firm owners based on factors they know are important. Ad as heard on cnn. Ad use our tax forgiveness calculator to estimate potential relief available.

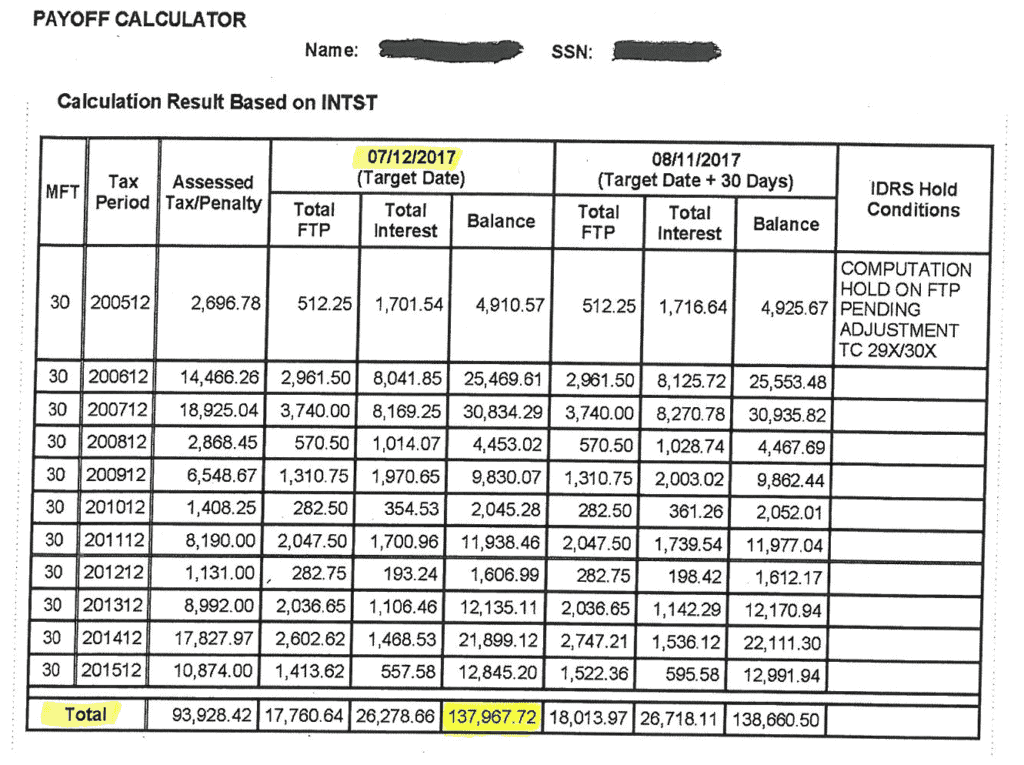

Don't let the irs intimidate you. Under its fresh start program, the irs offers several options for repaying back taxes. In principal, settling with the irs is like settling with any other creditor:

Get help from the best irs tax experts in the nation. Ad as heard on cnn. [ see all options ]

You can choose the oic periodic payment option. We have resolved over $1 billion dollars in tax debts for our clients. You demonstrate to them that you cannot pay the full amount of the debt and offer them something less than that as.

Get a report on the top 10 tax firms that specifically fix major irs tax problems. Continue to pay the remaining balance in monthly installments while the irs considers your offer. For most cases solely involving deficiencies or liabilities for taxes or penalties, including employment taxes in section 7436 cases, the form of the settlement document will.

An installment agreement is the most common method to pay back taxes to the irs. End your irs tax problems. This allows you to make the settlement in installments.

/images/2019/06/10/woman-settles-tax-debt.jpg)